SFDR Sustainability-Related Disclosures

SUSTAINABILITY-RELATED DISCLOSURE

Product Name: Japan Hotel REIT Investment Corporation

Legal Identifier: 353800L8KG849FP1JI68

Japan Hotel REIT Investment Corporation ("JHR") (hereafter referred to as "we", "us" or "our") promotes environmental or social characteristics, but does not have as its objective a sustainable investment within the meaning of article 9(1) of Regulation (EU) 2019/2088 ("SFDR"). We have no reference benchmark designated for the purposes of attaining the environmental or social characteristics promoted by our investment units.

Summary

| No sustainable investment objective | The financial products offered by JHR promote environmental or social characteristics, but do not have as its objective sustainable investment. |

|---|---|

| Environmental or social characteristics of the financial product | We, together with Japan Hotel REIT Advisors (the "Asset Manager"), are making efforts to enhance the sustainability of our business through consideration of ESG issues. We and the Asset Manager established a Sustainability Policy in December 2017 and are pursuing a series of ESG measures, including reduction of our environmental impact in consideration of all of our stakeholders. We have implemented various environmental initiatives and various social initiatives at our properties, as described below. |

| Investment strategy | Our basic investment thesis is to achieve steady growth and stable revenue over the medium to long term. We aim to maximize unitholder value by acquiring highly competitive hotels in areas with strong demand from both domestic and inbound leisure customers. We may issue green bonds and enter into green loans that take into consideration ESG factors using our Green Finance Framework, which JHR formulated in January 2024. In addition, when the Investment and Operation Committee and the Compliance Committee of the Asset Manager make a decision to invest in a property, findings about the property on the sustainability considerations are incorporated into the overall investment proposal. |

| Proportion of investments | We use BELS and CASBEE for the environmental certification of the properties in our portfolio. We call our property that receives any such certifications as "Green Certified Asset". The percentage of Green Certified Assets in our portfolio is not high mainly due to a limited number of green certification organization in Japan that review and issue green certifications to hotel properties. |

| Monitoring of environmental or social characteristics | We use the following indicators to measure the attainment of the E/S characteristics we promote; (i) Environmental Certification; (ii) GRESB Real Estate Assessment; (iii) SMBC Environmental Assessment Loan; (iv) Tracking of environmental performance data. |

| Methodologies | We have established the ESG Promotion Committee, which generally meets at least once every quarter, to establish targets and measures to be undertaken, assess the progress and conduct sustainability training for officers and employees. The ESG Promotion Committee consists of the Asset Manager’s management and officers and employees chosen from various groups involved in promoting ESG, with the President & CEO acting as the chair and the Board Director & Head of Finance and Planning acting as the operating officer. We also established the ESG team, which implements ESG initiatives under the ESG Promotion Committee. The ESG team is consisting of employees chosen from different departments involved in promoting ESG. Details on the indicators above are described below. |

| Data sources and processing | As further described below, the Asset Manager obtains certain ESG-related data with the assistance of a third-party vendor. In addition, the Asset Manager ensures data accuracy through certification by the independent certifying organization. |

| Limitations to methodologies and data | The primary limitation to methodologies and data is the necessity of reliance on tenants and property management companies for data at the property level. Like many other real estate investment corporations and asset managers, we rely on data provided by the tenants and property management companies. In addition, data at the property level provided by the tenants and property managers is generally updated on an annual basis. Accordingly, property-specific data will therefore not always be fully up-to-date. Data at the property level is compiled internally at the Asset Manager, but the data is confirmed by the relevant departments and the environment-related data at the property level is verified by a third-party organization. Limitations to the methodologies and data are not expected to affect the attainment of the environmental or social characteristics promoted by JHR in any material way. |

| Due diligence | Prior to JHR’s investment in a property, the Asset Manager conducts due diligence review of the property, including the assessment of compliance with applicable environmental laws and ordinances, environmental performance and environmental and disaster risks, as well as investigation into hazardous substances and soil contamination. |

| Engagement policies | We do not consider investing in properties that do not meet the standards for soil contamination and other environmental contamination in accordance with the Air Pollution Control Act and the Soil Contamination Countermeasures Act of Japan and other environmental laws and ordinances. However, from time to time we acquire properties not meeting the standards as long as they are deemed fixable promptly after acquisition. When we select assets for investment in connection with green bonds and green loans, we do not consider properties that do not meet the Eligibility Criteria and do not qualify as Green Projects for investment. In addition, in more than half of our leases for hotels owned by JHR, we include Green Lease provisions that require our tenants to collect energy consumption data and provide them to us. |

| Designated reference benchmark | We use the Nikkei Index only as a reference benchmark for performance comparison and market context purposes. |

No sustainable investment objective

The financial products offered by JHR promote environmental or social characteristics, but do not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

We, together with the Asset Manager, are making efforts to enhance the sustainability of our business through consideration of ESG (Environment, Social & Governance) issues, on the belief that sound management, which enables us to co-exist in harmony with society and our environment, will improve unitholder value over the medium to long term. We and the Asset Manager established a Sustainability Policy in December 2017 and are pursuing a series of ESG measures, including reduction of our environmental impact in consideration of all of our stakeholders. In December 2021, in order to further enhance our ESG initiatives, we identified the ESG issues that we consider to be most material to us and are promoting measures to address those issues.

We have implemented various environmental initiatives including the following.

- Reducing GHG emissions. We aim to reduce GHG emissions by 30% per floor area in our portfolio(GHG emissions intensity)compared to FY2017 until 2050 as a long term target. As of today, we have installed LED lighting and inverter control devices on air conditioning units at most of our properties, and water-saving devices at many of our properties. In addition, we reduce clean water consumption by using well water or by reusing gray water as recycled water.

- Preserving the Local Environment. Hotel Nikko Alivila participates in beach clean-up activities every year in Yomitan, hosted by Yomitan Village in Okinawa. Nirai Beach is located in front of Hotel Nikko Alivila, which is famous for having one of the most beautiful ocean waterfronts on Okinawa’s main island. The hotel staff cleans the beach every morning and conducts beach preservation activities, and as a result, visitors are able to observe sea turtles laying eggs and eggs hatching on the beach. Hotel Nikko Alivila is a member of the Sea Turtle Association of Japan.

We have implemented various social initiatives at our properties including the following.

- Supporting Cultural Activities and Child-rearing in Local Communities. Based on the policy of making itself "friendly to the Earth, local community and family," Oriental Hotel tokyo bay proactively engages in local community events, such as local festivals and events to promote disaster preparedness. Oriental Hotel tokyo bay also supports local art and cultural activities by hosting an annual chapel concert and providing our space for galleries. Oriental Hotel tokyo bay is also dedicated to supporting child care such as through cooperation with an after-childbirth support project sponsored by Urayasu City to provide physical and mental health care to mothers and their babies. In 2010, the hotel received the Kids Design Award, co-sponsored by the Kids Design Association, a non-profit organization that aims to enhance safety for children and create a society that enables their healthy growth, and the Ministry of Economy, Trade and Industry of Japan, the first for a hotel in Japan.

- Initiatives for HR Development. To help development of its real estate management professionals, the Asset Manager supports them in acquiring professional certifications such as ARES (Association for Real Estate Securitization) Certified Master, an educational program that teaches practical, specialized knowledge in the real estate and finance fields, for all officers and employees. We cover the full cost of participation in training relating to practical knowledge, industry trends and compliance.

- Initiatives for Employee Health and Well-being. The Asset Manager has established a Health Committee to improve standards of health for employees and promote wellness. The committee, which meets once a month, reviews employee health-related matters, including the status of work performed by all employees and the well-being and safety of the work environment. After each committee meeting, advice from an occupational health physician, who is a member of the Health Committee, is distributed to all employees. The Asset Manager subsidizes the costs of annual physical exams and flu shots. The Asset Manager also allows our employees to consult with an occupational health physician about mental health issues as needed.

- Respect for Human Rights, Diversity and Equality of Opportunities. Internal rules of the Asset Manager explicitly prohibit discrimination based on ethnicity, religion, gender, age, origin or nationality. Through compliance training, we promote respect for diversity of perspectives and values and raise awareness to eliminate discrimination and harassment.

- Whistleblowing. The Asset Manager has established whistleblower rules and a whistleblowing hotline that allows its officers and employees (including contract and temporary employees) to report or consult about potential harassment, fraud or other inappropriate acts. In accordance with the Whistleblower Protection Act of Japan, the rules protect whistleblowers by prohibiting mistreatment upon whistleblowing, allowing anonymous reports and keeping whistleblowers’ reports confidential, and stipulate procedures to find and correct reported acts, including investigation methods and disciplinary actions for those who are found to have engaged in inappropriate behavior. In addition to an in-house contact, a whistleblower may consult an outside attorney who has no business relationship with the Asset Manager.

- Communication with Employees. The Asset Manager conducts a biannual employee satisfaction survey to consider and implement improvement measures. The Asset Manager also organizes workshops that both senior level and junior level employees attend to discuss our branding strategy and share values with each other, with the aim of becoming a better company through two-way communication between management and employees. The Asset Manager also takes into consideration proposals for workplace improvement that we learn from employees during those workshops.

- Contribution to an Inclusive Society. The Asset Manager has introduced a re-employment system for employees aged 60 and over who wish to continue working. The Asset Manager has established a labor environment where senior personnel may remain active after the official retirement age by leveraging their work experience and expertise.

Investment Strategy

JHR invests directly or indirectly through trust beneficiary interests in real estate. Therefore, due diligence (including the assessment of good governance practices) in relation to investee companies is not applicable to us. We are a J-REIT that specializes in investment in hotels. Our basic investment thesis is to achieve steady growth and stable revenue over the medium to long term. We aim to maximize unitholder value by acquiring highly competitive hotels in areas with strong demand from both domestic and inbound leisure customers.

We issue green bonds and enter into green loans (collectively "Green Finance") that take into consideration ESG factors using our Green Finance Framework as follows.

- Green Finance Framework. In January 2024, JHR formulated the Framework in accordance with the Green Bond Principles (2021) established by the Green Bond Principles and Social Bond Principles Executive Committee, a private organization with the International Capital Markets Association ("ICMA"), the Green Loan Principles (2023) established by the Loan Market Association ("LMA"), the Asia Pacific Loan Market Association ("APLMA"), and the Loan Syndications and Trading Association ("LSTA"), the Green Bond Guidelines (2022) formulated and published by the Ministry of the Environment of Japan in March 2017 and revised in March 2020 and July 2022, and Green Loan Guidelines (2022) formulated and published by the Ministry of the Environment of Japan in March 2020 and revised in July 2022.

(Note) Information about the former Green Bond Framework that applies to the green bonds issued prior to the Green Finance Framework can be found on our website:

[Green Finance|ESG|Japan Hotel REIT Investment Corporation (jhrth.co.jp/en))] - Use of Proceeds. Under this Framework JHR will allocate the funds procured through the Green Finance to the following three purposes that meet the Eligibility Criteria described below: (i) for the acquisition of green buildings or refinancing of the funds used for the acquisition, (ii) for renovation work, and (iii) for the acquisition or installation of renewable energy generation equipment.

<Eligibility Criteria>

-

Green building

Properties that have obtained or renewed certification from any of the following third-party certification organizations or properties that intend to obtain or renew such certification:- DBJ Green Building Certification

: 3-star, 4-star or 5-star ratings - CASBEE Certification (including Municipal CASBEE)

: B+, A or S rank - BELS Certification

: 3-star, 4-star or 5-star ratings (based on FY2016) - LEED Certification

: Silver, Gold or Platinum - BREEAM Certification

: Very good, Excellent or Outstanding -

Renovation work

Renovation work that meets any of the following:- Renovation work that has the effect of reducing any of the following: CO2 emissions, energy consumption, or water consumption by 30% in real estate owned by JHR

- Renovation work intended to improve one or more stars or ranks of certification by third-party certification organizations as defined in the above Eligibility Criteria (i)

-

Renewable energy

Acquisition or installation of the following renewable energy power generation equipment:- Solar power generation

- Onshore wind power generation (limited to equipment with output of less than 20kW)

- Biomass power generation (limited to equipment where fuel is sourced from its location or adjacent prefectures)

-

Green building

When the Investment and Operation Committee and the Compliance Committee of the Asset Manager make a decision to invest in a property (subject to the approval of the Board of Directors of the Asset Manager), findings about the property on the sustainability considerations are incorporated into the overall investment proposal. To the extent possible, the Committees generally exclude investment proposals with the following ESG issues: (i) the level of asbestos in the property, after removal or treatment, exceeds the maximum level permitted under applicable environmental law; (ii) the usage and disposal of PCB-containing machines in the property are not properly handled in accordance with relevant law; (iii) soil contamination, after treatment, exceeds the maximum level permitted under applicable environmental law.

In addition, when we select assets for investment in connection with the Green Finance, the properties must meet the Eligibility Criteria described above. The eligible assets are evaluated and selected by the Asset Manager’s finance department after discussion with internal engineers, in accordance with the targets set by Asset Manager’s ESG Promotion Committee ("Green Projects"). The Green Projects must be approved by the Asset Manager’s Investment and Operation Committee, the Board of Directors, and JHR's Board of Directors. The ESG Promotion Committee consists of the Asset Manager’s management and officers and employees chosen from various groups involved in promoting ESG, with the President & CEO acting as the chair and the Director & Head of Finance and Planning acting as the operating officer.

Furthermore, we, along with the Asset Manager, have introduced the following measures to assess and enhance our governance systems:

- Initiatives to Prevent Conflicts of Interest. The Asset Manager has formulated a decision-making process that is stricter than what is required by law. In particular, in addition to interested parties stipulated by applicable law, the Asset Manager specifies "sponsor-related parties", including the Asset Manager’s shareholders and their subsidiaries, which are subject to detailed standards and procedures. Certain transactions with sponsor-related parties require a resolution of the Board of Directors of the Asset Manager and a resolution of our Board of Directors in addition to deliberation and approval by the Investment and Operation Committee and the Compliance Committee of the Asset Manager.

- Risk Management. The Asset Manager has established a risk management system for the purpose of ensuring sound management and performing appropriate risk management as a financial instruments business operator. In addition, the Asset Manager’s Board of Directors has established a risk management policy and strategic objectives and supervises the development of an appropriate risk management system.

- Internal Audit. The Asset Manager conducts annual internal audits at least once a year, in order to evaluate its risk management. Once the internal audit is completed, the compliance officer, who serves as the chief controller of internal audit, reports the audit results to the President of the Asset Manager, Compliance Committee and the audited departments. The chief controller of internal audit also reports to the Board of Directors as necessary. The chief controller of internal audit quarterly reviews the progress made on matters for improvement indicated by internal audits and reports the results to the President and Compliance Committee.

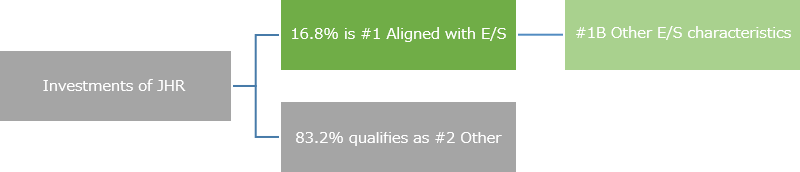

Proportion of investments

We use BELS and CASBEE for the environmental certification of the properties in our portfolio. We call our property that receives any such certifications as "Green Certified Asset". As of March 31, 2024, 16.8% of the properties in our portfolio were Green Certified Assets, and 83.2% were noncertified assets based on gross floor area. The percentage of Green Certified Assets in our portfolio is not high mainly due to a limited number of green certification organization in Japan that review and issue green certifications to hotel properties.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

Monitoring of environmental or social characteristics

We use the following indicators to measure the attainment of the E/S characteristics we promote.

- Environmental Certification. In order to ensure the credibility of our initiatives aimed at reducing our environmental impact, we have obtained green building certifications from third-party experts such as the Comprehensive Assessment System for Built Environment Efficiency ("CASBEE") for Buildings and Building-Housing Energy-efficiency Labeling System ("BELS") Evaluation.

- GRESB Real Estate Assessment. The GRESB, established in 2009, validates ESG performance data and provide benchmarks for measuring real estate companies’ and institutional investors’ commitment to sustainability. Leading European, U.S., and Asian institutional investors use these benchmarks in selecting investment targets.

- SMBC Environmental Assessment Loan. The SMBC Environmental Assessment Loan is a loan provided by Sumitomo Mitsui Banking Corporation based on environmental assessment conducted by the Japan Research Institute, Limited, which reviews the borrower’s environmental management comprehensively based on four criteria: (i) awareness of environmental load; (ii) extent of environmental conservation measures and results; (iii) its environmental management system; and (iv) initiatives for environmental communication and environmental business.

- Tracking of environmental performance data. The Asset Manager tracks and monitors data on energy consumption, CO2 emissions, water use and generated waste of hotels leased to Hotel Management Japan Co., Ltd. and its subsidiaries owned by JHR.

Methodologies

We have established the ESG Promotion Committee, which generally meets at least once every quarter, to establish targets and measures to be undertaken, assess the progress and conduct sustainability training for officers and employees. The ESG Promotion Committee consists of the Asset Manager’s management and officers and employees chosen from various groups involved in promoting ESG, with the President & CEO acting as the chair and the Board Director & Head of Finance and Planning acting as the operating officer. We also established the ESG team, which implements ESG initiatives under the ESG Promotion Committee. The ESG team is consisting of employees chosen from different departments involved in promoting ESG.

- Environmental Certification. The ESG team discusses the status of the acquisition of certifications and reports to the ESG Promotion Committee as well as discloses it on our website. The Asset Management Department of the Asset Management Department of the Asset Manager takes the lead in collecting performance data related to the environmental certifications, and has the collected data certified by the independent certifying organization. Upon acquiring environmental certifications, the Asset Management Department assesses, in additions to the items such as compliance with applicable laws and disaster risks, indoor and outdoor environment and service-related functions of each property.

- GRESB Real Estate Assessment. The ESG team oversees the process for the GRESB Real Estate assessment, with the assistance of a consulting firm. The assessment process for the GRESB Real Estate Assessment involves submission of our responses to ESG questionnaires and relevant data to GRESB. The Asset Management Department of the Asset Manager collects the performance data and the ESG team collects other data, both of which are submitted to and validated by GRESB. ESG-related matters such as energy-saving measures taken and environmental performance at our properties are taken into account in the assessment process. The results are reported from the ESG team to the ESG Promotion Committee and then disclosed on our website.

- SMBC Environmental Assessment Loan. The Asset Management Department and the Finance Department of the Asset Manager collects the data used in the valuation. The ESG team confirms the accuracy of the collected data through a process that includes the advice of the Environmental Considerations Evaluation Agency. The results are reported from the ESG team to the ESG Promotion Committee and then disclosed on our website.

- Tracking of environmental performance data. The performance data is collected by a third-party vendor, and the Asset Management Team of the Asset Manager receives reports of such collected data. The performance data is collected on a monthly frequency, and the collected data is certified by the independent certifying organization.

Data sources and processing

We use the following data sources:

- Environmental Certification. The property-level ESG performance data for obtaining the environmental certifications is collected by the Asset Management Department of the Asset Manager with the assistance of a third-party vendor. The collected data is certified by the independent certifying organization.

- GRESB Real Estate Assessment. The Asset Management Department of the Asset Manager collects the property-level performance data and the ESG team collects other data, both of which are submitted to and GRESB for assessment. We retain an external consulting firm to ensure data accuracy.

- SMBC Environmental Assessment Loan. The Asset Management Department of the Asset Manager mainly collects the performance data, which is then confirmed by the ESG team with the advice of the Environmental Considerations Evaluation Agency to ensure data accuracy.

- Tracking of environmental performance data. The Asset Management Department of the Asset Manager collects the performance data with the assistance of a third-party vendor. The collected data is certified by the independent certifying organization.

Limitations to methodologies and data

The primary limitation to methodologies and data is the necessity of reliance on tenants and property management companies for data at the property level. Like many other real estate investment corporations and asset managers, we rely on data provided by the tenants and property management companies. In addition, data at the property level provided by the tenants and property managers is generally updated on an annual basis. Accordingly, property-specific data will therefore not always be fully up-to-date.

Data at the property level is compiled internally at the Asset Manager, but the data is confirmed by the relevant departments and the environment-related data at the property level is verified by a third-party organization.

Limitations to the methodologies and data are not expected to affect the attainment of the environmental or social characteristics promoted by JHR in any material way.

Due diligence

Prior to JHR’s investment in a property, the Asset Manager conducts due diligence review of the property, including the assessment of compliance with applicable environmental laws and ordinances, environmental performance and environmental and disaster risks, as well as investigation into hazardous substances and soil contamination. Such due diligence process encompasses various studies of ESG-related risks as a basis for deliberations at the Investment Management Committee and eventual investment decision at the Board of Directors. Specifically, the Asset Manager obtains engineering reports on the use of hazardous substances such as asbestos and polychlorinated biphenyls (PCBs), as well as building environmental risk and disaster risk assessment studies, and the Acquisitions Department of the Asset Manager examine the data closely for consistency with the Asset Management Guidelines. The results of the above examination will be reported at the Investment Management Committee and the Board of Directors meetings of the Asset Manager, and based on these reports, a determination will be made as to whether the property is suitable as an investment target.

Engagement policies

We do not consider investing in properties that do not meet the standards for soil contamination and other environmental contamination in accordance with the Air Pollution Control Act and the Soil Contamination Countermeasures Act of Japan and other environmental laws and ordinances. However, from time to time we acquire properties not meeting the standards as long as they are deemed fixable promptly after acquisition.

When we select assets for investment in connection with the Green Finance described above, we do not consider properties that do not meet the Eligibility Criteria and do not qualify as Green Projects for investment.

In addition, in more than half of our leases for hotels owned by JHR, we include Green Lease provisions that require our tenants to collect energy consumption data and provide them to us.

Designated reference benchmark

Our investment units have been included in the Nikkei ESG-REIT index ("Nikkei Index"), which was newly established in 2020, since its establishment. The Nikkei Index is composed of Tokyo Stock Exchange-listed J-REITs weighted by market capitalization adjusted for ESG considerations, including GRESB ratings. The index is reviewed annually for inclusion or exclusion every November. We use the Nikkei Index only as a reference benchmark for performance comparison and market context purposes.

REMUNERATION AND SUSTAINABILITY RISKS (SFDR ARTICLE 5 DISCLOSURE)

The Asset Manager has a remuneration policy in place which aims to support its strategy, values and long-term interest, including its interest in sustainability. The Asset Manager’s remuneration policy is consistent with the integration of sustainability risks, as follows:

- Remuneration, methods of calculation and payment and timing of payment are determined according to the Asset Manager’s compensation rules.

- Base salary for each employee of the Asset Manager is determined every year on January at the Asset Manager’s discretion, considering factors such as performance of and economic conditions surrounding the Asset Manager, and such employee’s duties/ position, performance, ability, achievement and contribution, which may include those with respect to ESG, and years in service.

- Employees may receive various allowances such as those for housing, unemployment insurance, commutation, retirement, and overtime and day-off work charge.

- Employees may receive bonuses, which amount is determined by the Asset Manager considering the performance and profits of the Asset Manager and the achievement and contribution of each employee, which may include those with respect to ESG; provided, however, that the Asset Manager may decide not to pay bonuses depending on the above factors. Methods of calculation and timing of payment are determined according to compensation rules.

INTEGRATION OF SUSTAINABILITY RISKS IN THE INVESTMENT DECISIONS, AND THE IMPACT OF SUCH RISKS ON THE RETURNS OF JAPAN HOTEL REIT INVESTMENT CORPORATION (SFDR ARTICLE 6 DISCLOSURE)

We have established the ESG Promotion Committee, which generally meets at least once every quarter, to establish targets and measures to be undertaken, assess the progress and conduct sustainability training for officers and employees. The ESG Promotion Committee consists of the Asset Manager’s management and officers and employees chosen from various groups involved in promoting ESG, with the President & CEO acting as the chair and the Board Director & Head of Finance and Planning acting as the operating officer.

Under this organizational structure, we have instituted a number of initiatives to promote E/S characteristics. Such initiatives include climate change initiatives, initiatives for saving/reducing energy consumption, local community initiatives, and initiatives for employees’/tenant’s initiatives.

In order to conduct sustainable asset management while maximizing the value of our properties, we have taken into consideration ESG factors in our investment and asset management processes. In addition, we have established the Green Finance Framework in relation to fund procurement as described in more detail above. Our Sustainability Policy clearly states that we consider the environment and stakeholders such as members of local communities surrounding our properties, and we request our hotel tenants to cooperate with our sustainability initiatives. We consider environmental and social factors when procuring products and services.

While sustainability issues will severely impact our business activities, we believe that such issues may also become potential business opportunities to create new value for sustainable growth. Accordingly, we position our commitment to sustainability as one of the top priorities in our management strategies. We also believe that integrating sustainability factors alongside traditional financial and operational metrics in our investment decision process helps us make a more holistic assessment of a property’s risks and opportunities and is commensurate with the pursuit of superior risk-adjusted returns. In other words, we believe that if we fail to consider ESG factors enough in the investment decision-making process, it may cause the increase of capital cost and even reduce investors’ returns. If our ESG initiatives are not sufficient, our investment units may be excluded from ESG stock indices or may be excluded from investment by investors who use the status of ESG initiatives as one of their investment criteria. As a result, the investment unit price may be adversely affected. We are exposed to the following risks in particular.

Transition risks and Physical risks

In order to examine the impact of climate-related risks and opportunities on the JHR's business, strategy and financial plan, we conducted scenario analysis using the 4℃ and 1.5℃ scenarios. In the scenario analysis, we refer to the Fifth Assessment Report published by the IPCC (Intergovernmental Panel on Climate Change of the United Nations) and World Energy Outlook 2020 published by the IEA (International Energy Agency) to analyze the impact on JHR's business by measures such as Japanese government's "Carbon Neutral Declaration" in mind for the transition of the social economy to decarbonization and the increasingly serious and frequent occurrence of natural disasters due to the progress of climate change.

| Scenario | Transition risk | Physical risk |

|---|---|---|

| 4℃ Scenarios | STEPS (IEA WEO2020) | RCP8.5 (IPCC Fifth Assessment Report) |

| 1.5℃ Scenarios | NZE2050 (IEA WEO2020) | RCP2.6 (IPCC Fifth Assessment Report) |

For each of the above 4℃ and 1.5℃ scenarios, we have evaluated the magnitude of the financial impacts on JHR which will be caused by the identified risks and opportunities. For each scenario, we evaluated the impact in the years 2025 (short-term), 2030 (medium-term) and 2050 (long-term) on a scale of large, medium and small. The accuracy of this assessment is not guaranteed, as it is a relative impact assessed based on a qualitative analysis and includes various factors such as uncertain assumptions and unknown risks over the medium to long term. A summary of the results is shown in the table below.

| Category | Risk and Opportunity Factors |

Financial Impact | Initiatives and Countermeasures |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Changes | Classifi- cation |

4℃ | 1.5℃ | |||||||

| Short- Term |

Mid- Term |

Long- Term |

Short- Term |

Mid- Term |

Long- Term |

|||||

| Transition Risks | ||||||||||

| Policy and Legal |

Strengthening taxation on GHG emissions through the introduction of a carbon tax | Increase in tax burden on GHG emissions from properties under management | Risks | Minor | Minor | Minor | Minor | Mode- rate |

Major |

|

| Expansion and mandate of labeling systems related to energy efficiency and sustainability initiatives for buildings | Rise in expense of acquiring environmental certification | Risks | Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

||

| Technology | Evolution and diffusion of renewable energy and energy-saving technologies | Increase in expenses for introducing new technology for equipment in properties under management | Risks | Minor | Minor | Minor | Minor | Minor | Mode- rate |

|

| Reduction of utility costs through the introduction and replacement of equipment with high energy-saving performance | Oppor- tunities |

Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

|||

| Market and Reputation |

Changes in the investment attitude and investment and financing decisions of market participants | Deterioration of financing conditions and increase in financing costs due to delay in response to climate change | Risks | Minor | Minor | Minor | Minor | Minor | Mode- rate |

|

| Increase funding volume and lower funding costs by responding to and appealing to investors who are concerned about environmental issues | Oppor- tunities |

Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

|||

| Change in demand from hotel lessees and hotel guests (avoiding properties that are less climate-responsive) | Decrease in rents due to increased costs for responding to the demands of hotel lessees, etc. and hotel users (guests) and deterioration of reputations due to non-response | Risks | Minor | Minor | Minor | Minor | Minor | Mode- rate |

||

| Increase market recognition and market competitiveness as an eco-friendly property | Oppor- tunities |

Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

|||

| Physical Risks | ||||||||||

| Acute | Damage to property caused by typhoons and other wind damage | Increase in repair and insurance costs, loss of sales opportunities and lower occupancy rates | Risks | Minor | Minor | Mode- rate |

Minor | Minor | Minor |

|

| Floods of nearby rivers and rainfall inundation caused by torrential rains, etc. | Increase in repair and insurance costs, loss of sales opportunities and lower occupancy rates | Risks | Minor | Minor | Mode- rate |

Minor | Minor | Minor | ||

| Chronic | Increase in demand for air conditioning due to increase in extreme weather conditions such as extremely hot and cold weather | Increase in utility costs, as well as maintenance and repair costs | Risks | Minor | Minor | Mode- rate |

Minor | Minor | Minor |

|

| (※) |

"Transition Risks" and "physical Risks" are as follows. "Transition Risks": Business impacts arising from the social economy's transition to a low-carbon, decarbonized economy

|

Social and governance risks

We are exposed to the risk that any of our hotels will become subject to a serious public criticism regarding any social or governance aspect of the hotel that makes our holding of the hotel inconsistent with our ESG policy. We view this risk as a low-level risk because we test each of our hotels against our ESG policy on an ongoing basis and, in case of non-compliance with our ESG policy, promptly take measures to rectify the non-compliance upon consultation with independent experts as necessary.

PRINCIPAL ADVERSE IMPACT STATEMENT

- June 30,2023

- Principal Adverse Impact StatementPDF(188KB)