Governance

Corporate Governance

JHR's Governing Bodies

Based on the Act on Investment Trusts and Investment Corporations ("the Investment Trusts Act"), organizational management of JHR is handled by the General Meeting of Unitholders, which is comprised of unitholders, and the Board of Directors, including one Executive Director (male) and three Supervisory Directors (one male, two females), and an Accounting Auditor. For details, please refer to "Our Organization."

Executive Director and Supervisory Directors

●Status and term of directors

The Executive Director executes the business of JHR, represents the company, and possesses the authority to perform any acts in or out of court relating to the business of JHR.

The Supervisory Directors possess the authority to supervise the execution of the Executive Directors' duties. They may request reports relating to the status of JHR's business and assets from not only the Executive Director but also administrative agents, the asset management company, and the asset custody company, and they may also conduct any investigations that are required.

Executive Director and Supervisory Directors were elected by resolution of general meeting of unitholders and term of office is two years following their appointment.

With regard to the status of the Executive Director and Supervisory Directors, please refer to "Director Profiles."

●Independence of directors

In order to secure high independency of Executive Director and Supervisory Directors from JHRA and its sponsor-related parties, JHR elects person without any relation with JHRA and its sponsor-related parties as its Executive Director and Supervisory Directors since April 1, 2012.

In cases of vacancy of the position of Executive Director or a shortfall in the number of Executive Director as stipulated by laws and regulations, representative director of JHRA may temporarily take position of Executive Director of JHR.

●Reasons for appointment of Directors and Board of Directors' Meeting attendance record

The directors were elected by a resolution of the General Meeting of Unitholders based on the reasons below, with the condition that they must not conflict with any of the reasons for disqualification stipulated in various laws and regulations, including the Investment Trusts Act (Article 98, 100, and 200 of the Investment Trusts Act, Article 244 of the Ordinance for Enforcement of the Investment Trusts Act). The Executive Director and Supervisory Directors consist of third parties who have no special interest with JHR.

| Title of Officer | Name | Reasons for Appointment | Gender | Board of Directors Meeting Attendance Record(*) |

|---|---|---|---|---|

| Executive Director | Kaname Masuda | Possesses high experience and knowledge as a professional of law with central focus on corporate law. Familiar with unique mechanism and structure of a J-REIT through his practical experience and possesses considerable insight of management. | Male | 88.2% (15/17 meetings) |

| Supervisory Director | Tetsuya Mishiku | Expected to supervise investment corporation management from various standpoints including specific field based on the high experience, knowledge etc. he has acquired as a legal expert with central focus on compliance-related matters. | Male | 82.4% (14/17 meetings) |

| Supervisory Director | Mayumi Umezawa | Expected to supervise management from various standpoints including specific field based on the high experience and knowledge as professional of accounting. | Female | 94.1% (16/17 meetings) |

| Supervisory Director | Akiko Tomiyama | Expected to supervise management from various standpoints including specific field based on the high experience and knowledge as legal expert. | Female | 100% (2/2 meetings) |

| (*) | Shows the attendance record at board of directors meetings held during the 24th fiscal period (ended December 2023). |

|---|

Remuneration of Directors

●Remuneration of Executive Director and Supervisory Directors

As stipulated in JHR's Articles of Incorporation, the amount of remuneration for the Executive Director and Supervisory Directors shall be determined by the Board of Directors, with a maximum of 800,000 yen/month per person for the Executive Director and a maximum of 500,000 yen/month per person for the Supervisory Directors. The remuneration amount for each director is as shown in the table below. For records of remuneration for each position during previous business periods, please refer to the asset management reports in the "IR Library."

(Unit: Thousands of Yen)

| Position | Name | Total Remuneration for Each Position in the 24th Fiscal Period (Ended December 2023) |

|---|---|---|

| Executive Director | Kaname Masuda | 6,600 |

| Supervisory Director | Tetsuya Mishiku | 3,600 |

| Supervisory Director | Mayumi Umezawa | 3,600 |

| Supervisory Director | Akiko Tomiyama | 600 |

●Remuneration of Accounting Auditor

The amount of remuneration for the Accounting Auditor shall be determined by the Board of Directors, with a maximum of 30,000,000 yen per business period. The remuneration amount for the Accounting Auditor is as shown in the table below. For records of remuneration during previous business periods, please refer to the asset management reports in the "IR Library."

(Unit: Thousands of Yen)

| Title | Company Name | Remuneration for the 24th Fiscal Period (Ended December 2023) |

|---|---|---|

| Accounting Auditor | KPMG AZSA LLC | 29,550 |

| (*) | Remuneration for the independent auditor includes fees of 3,300 thousand yen for preparing comfort letters associated with the issuance of new investment corporation units. |

|---|

●Fees paid to JHRA

Since JHR is prohibited from hiring employees based on the provisions of the Investment Trusts Act, it entrusts asset management to JHRA without hiring any personnel.

In accordance with the asset management contract signed between the two parties, JHR pays asset management fees to JHRA. The types of fees, methods of calculating them, and total amounts are as shown below.

(Calculation Methods)

| Fee Type | Fee Calculation Method |

|---|---|

| Management fee 1 | On the final day of March, June, and September in each business period and the fiscal year-end of each business period (the "calculation reference dates"), JHR shall pay the amount obtained by multiplying its total assets by a rate it has agreed separately with JHRA, up to a maximum of 0.35% per annum, on a daily pro-rated basis for the number of days between the previous calculation reference date (which is not included) and the current calculation reference date (which is included), taking one year to be 365 days and rounding down to the nearest yen. |

| Management fee 2 | JHR shall pay the amount calculated by multiplying its NOI (Net Operating Income) for each business period by a rate it has agreed separately with JHRA, up to a maximum of 1.0%, rounded down to the nearest yen. |

| Management fee 3 | JHR shall pay the amount calculated by multiplying the amount obtained by dividing the total dividend amount for a given business period before deducting management fee 3 by the total number of investment units issued as of the last day in December in that period (rounded down to the nearest yen) by a coefficient that it has agreed separately with JHRA, up to a maximum of 43,000 (however, if the investment units were split, the figure will be 43,000 multiplied by the split ratio, and if the investment units were split multiple times, the same process will be repeated). |

| Acquisition fee | If real estate related assets, etc. (this refers to assets indicated in Article 28-2 through 28-4 of the Articles of Incorporation; the same applies hereinafter) are acquired, JHR shall pay the amount obtained by multiplying the acquisition price of the applicable real estate related assets, etc. (excluding amounts corresponding to consumption tax, etc. (as defined in Article 39 of the Articles of Incorporation; the same applies hereinafter) and expenses associated with acquisition) by a rate that it has agreed separately with JHRA, up to a maximum of 0.75% (rounded down to the nearest yen). However, if the applicable real estate related assets, etc. are acquired from sponsor-related parties, the rate to be applied shall be reduced by 0.25% from the rate to be applied in the case of acquisition from non-sponsor-related parties. |

| Disposition fee | In the event of real estate related asset, etc. are disposed, JHR shall pay the amount obtained by multiplying the disposition price of the applicable real estate related assets, etc. (excluding amounts corresponding to consumption tax, etc. and expenses associated with disposition) by a rate that it has agreed separately with JHRA, up to a maximum of 0.5% (rounded down to the nearest yen). However, in the case of disposition of the applicable real estate related assets, etc. to sponsor-related parties, the rate to be applied shall be reduced by 0.25% from the rate to be applied in the case of disposition to non-sponsor-related parties. |

| Merger fee | In a merger carried out by JHR, if JHRA investigates and evaluates the holdings of the other party in the merger and performs other merger-related tasks and assets belonging to the other party are then succeeded by JHR as a result of the merger, JHR shall pay JHRA a merger fee based on the provisions of the asset management contract signed between the two parties. The fee involved shall be the total of the amount obtained by multiplying the appraisal value of the real estate related assets, etc., succeeded by JHR at the time of the merger by a rate agreed separately with JHRA (rounded down to the nearest yen), up to a maximum of 0.25%, and the corresponding consumption tax on this amount. |

(Fee Amounts)

(Unit: Thousands of Yen)

| Fee Type | 22nd Fiscal Period (Ended December 2021) |

23rd Fiscal Period (Ended December 2022) |

24th Fiscal Period (Ended December 2023) |

|---|---|---|---|

| Management fee 1 | 1,367,633 | 1,352,064 | 1,391,457 |

| Management fee 2 | 63,667 | 109,633 | 223,446 |

| Management fee 3 | 15,910 | 29,627 | 130,849 |

| Sub total | 1,447,210 | 1,491,325 | 1,745,752 |

| Acquisition fees | 5,654 | - | 250,326 |

| Disposition fees | 56,500 | - | - |

| Merger fees | - | - | - |

| Total | 1,509,365 | 1,491,325 | 1,996,078 |

For records of the fees in the 20th fiscal period (ended December 2019) and previous fiscal periods, please refer to the asset management reports in the "IR Library."

Initiatives to Prevent Conflicts of Interest

JHRA believes that managing conflicts of interest in a strict manner is essential to gain trust from the unitholders of JHR and has formulated a decision-making process that is stricter than what is required by laws and regulations. In particular, in addition to interested person, etc. stipulated by laws and regulations, JHRA stipulates that "sponsor-related parties" include JHRA's shareholders, their subsidiaries, etc. and stipulates detailed standards and procedures pertaining to transactions between "sponsor-related parties" and JHR.

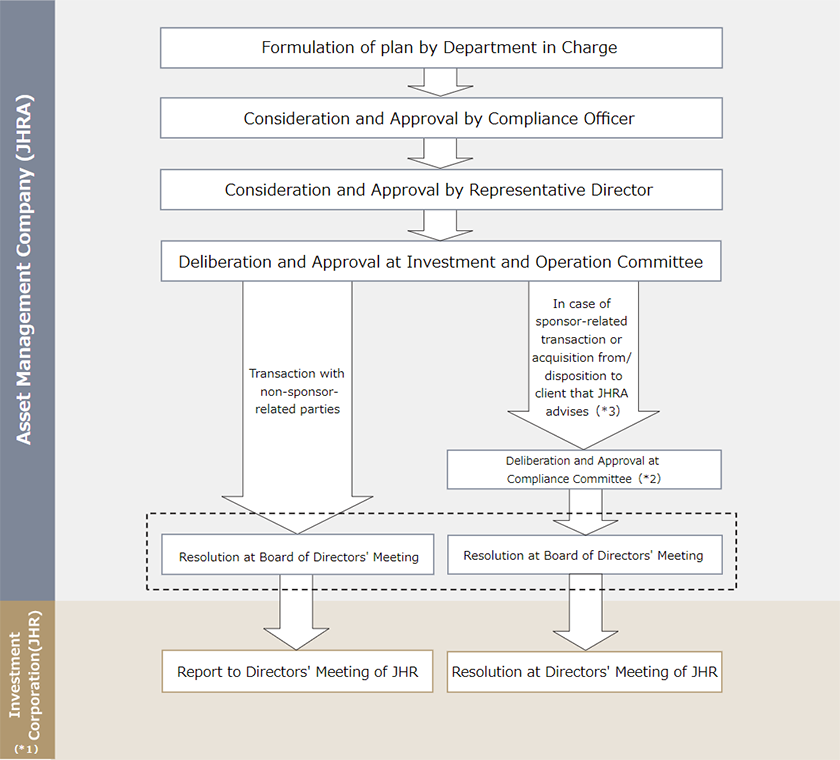

JHRA stipulates that, in cases where JHR conducts prescribed transactions with "sponsor-related parties," resolution at a board of directors' meeting and resolution at JHR's board of directors' meeting are required in addition to deliberation and approval at the Investment and Operation Committee and Compliance Committee.

Decision-making Process for Acquisition or Disposition of Assets under Management

JHR's decision-making process for acquiring or disposing assets under management is shown in the chart below.

With regard to transactions with "sponsor-related parties," JHR and JHRA have set decision-making rules stricter than what is required by laws and regulations. In order to manage conflicts of interest, we strive for compliance with "arms-length rules" and transparency. Furthermore, if a asset under management is acquired from or sold to "sponsor-related parties," compensation to be paid to JHRA will be reduced in accordance with provisions of the Articles of Incorporation.

Beside such, all transactions with "sponsor-related parties," including the conclusion of lease contracts, amendment of lease contracts and ordering of construction work, generally require the same decision-making process as transactions with "sponsor-related parties," along with attention paid to the fairness of the content by means of obtaining estimates from third parties and such.

| (*1) | The board of directors consists of third-party members who do not have any relationship with sponsor-related parties. |

|---|---|

| (*2) | JHRA stipulates that the compliance committee in principle requires an attendance of an outside specialist (attorney). The outside specialist is authorized to dismiss a proposal. |

| (*3) | In case of acquisition or disposition of assets between JHR and a client whom JHRA advices, such client will be treated as "sponsor-related parties." Moreover, JHRA stipulates that resolution on the said transaction at Investment and Operation Committee needs an attendance of an external expert (real estate appraiser), who has dismissal rights of proposed resolution. |

Compliance

Compliance Initiatives and System

To ensure appropriate asset management, sound and appropriate execution of operations, and protection of investors, JHR and JHRA have established a compliance-related management system. JHRA has positioned thorough compliance and business ethics issues such as anti-corruption, as the most important management issues, and have established a system for deliberation, decision-making, and management of various compliance-related matters under the authority and responsibility of the Board of Directors, the Compliance Committee, the President and Representative Director, and the Compliance Officer, respectively. Specifically, we have developed a Code of Compliance that stipulates basic policies for corporate ethics and behavioral guidelines for officers and employees and strives to maintain and implement compliance, carry out sincere and fair corporate activities, and ensure sound management based on self-discipline. Moreover, recognizing the importance of compliance, it has formulated a Compliance Manual, which stipulates standards of conduct for ensuring that compliance is implemented and achieved by officers and employees in day-to-day business operations, and a Compliance Program, which provides a practical plan for implementing compliance.

Anti-corruption Initiatives and Initiatives against Anti-social Forces

To prevent corruption and eliminate anti-social forces, JHRA ensures that all officers and employees (including contract and temporary employees, etc.; the same applies throughout this section) have a thorough understanding of related matters by conducting compliance training and other activities, as well as verifying implementation by conducting internal audits and administrative inspections, etc., each year.

●Anti-corruption initiatives

JHRA stipulates in its Code of Compliance, and Compliance Manual and Rules of Employment that all its officers and employees are required to eliminate any mixture of public and private affairs, and are prohibited from providing favors, benefits, etc. to civil servants of Japan or other countries or persons deemed as such, in accordance with Japanese and international laws. Furthermore, it stipulates that regardless of whether business-related transactions take place, it is prohibited to provide or accept favors, benefits, etc. that exceed the scope of courtesy based on socially accepted conventions.

Specifically, in order to ensure the fairness of transactions, each officer and employee is required to confirm and declare at the time of application for transactions that the transaction does not unfairly benefit himself/herself or a third party.

Based on the internal audits, administrative inspections, and so forth that it has conducted to date, JHRA has not found any favors or gifts that contravene the relevant laws. Moreover, there have been no violations of corruption-related laws or administrative sanctions.

Also, there are no violations of laws and regulations nor administrative actions charged by administrative bodies related to corrupt practices.

For details on internal audits, please refer to "Internal Audit" in Risk Management below.

●Initiatives to eliminate anti-social forces

JHRA has formulated and published a "Basic Policy Against Anti-social Forces" and strives to maintain the trust of all stakeholders and ensure sound operations and appropriate management by observing the policy. Furthermore, an organizational system has been established and implemented through the Code of Compliance Committee and Regulations for Handling anti-social forces which stipulate various procedures for severing any ties involving dealings with anti-social forces and prohibit providing payoffs to anti-social forces.

The following is an overview of the organizational system:

- A compliance officer is in charge of handling anti-social forces and severing any new ties with such forces and supervises JHRA's overall establishment of system.

- Each department acts as section responsible to handle initial reaction for anti-social forces and supervises the handling of individual cases.

- The compliance officer reports to the Compliance Committee and Board of Directors as needed with regard to the status of initiatives to sever and prevent ties with anti-social forces.

- The Compliance Committee and Board of Directors receive reports on the status of initiatives to sever and prevent ties with anti-social forces and grant approval for JHRA's specific and general initiatives and policies toward anti-social forces respectively as needed.

Initiatives Relating to Anti-money Laundering and Countering the Financing of Terrorism

In recent years, the importance of countermeasures to anti-money laundering and financing of terrorism (hereinafter referred to as "money laundering, etc.") as an issue that needs to be addressed by both Japan and global society has been growing. In collaboration with the relevant government ministries and agencies, financial institutions, etc. have been striving to maintain sound financial systems by enhancing their management systems for cutting off the flow of funds connected with criminals, terrorists, etc. (i.e., money laundering).

Recognizing the importance of countermeasures for money laundering, etc., JHRA complies with the relevant laws and regulations, including the Act on Prevention of Transfer of Criminal Proceeds. Moreover, in accordance with the Guidelines for Anti-Money Laundering and Combating the Financing of Terrorism developed and published by the Financial Services Agency in February 2018 and a risk-based approach, JHRA has established a risk management system that makes it possible to implement appropriate measures in a timely manner.

JHRA has formulated Regulations Concerning the Implementation of Verification to Execute Transactions, Etc. Based on the regulation, various verification procedures are implemented and audit and other activities on the procedures are conducted by a supervising officer (compliance officer).

Establishment of Whistleblower System

With an aim to contribute to strengthening compliance management, JHRA has established Regulation of Whistleblower. As such, JHRA has established a whistleblower system that allows its officers and employees (including contract and temporary employees) to report or discuss fraudulent acts.

"Regulation of Whistleblower" target any organizational or individual fraudulent acts including any harassment (including cases where fraudulent acts may occur) as the subject for reports or consultation (hereinafter called "Whistleblowing, etc."). Based on the Whistleblower Protection Act and company regulation, the regulation stipulates protection of whistleblower who reported or consulted (including prohibition of disadvantageous treatment, responding to anonymous reports, keeping the content confidential and elimination of conflicts of interest, etc.) as well as procedures to find and correct reported fraudulent acts (including research method, disposition of those who conduct fraudulent acts and following up with the whistleblowers).

Furthermore, in addition to assignment of Compliance Office as an in-house contact point (the President and Representative Director is the internal contact point for reporting of fraudulent acts, etc. by officers and employees of the Compliance Office), an external attorney who has no business relationship with JHRA is appointed as the reporting contact point in order to secure effectiveness of the whistleblower system. The contact information of each contact point is made known to all officers and employees through compliance trainings, and is explained to new employees in particular during the compliance training provided at the time they join the company.

In the specific process to handle reports, etc., when contact point received a report, etc., each contact point will consider the necessity of an investigation fairly, impartially, and in good faith, and will promptly notify the whistleblower of the results of the consideration and future actions against the case. And report the results of the investigation by the person in charge of the investigation to the whistleblower and the Compliance Committee.

If the investigation reveals fraudulent acts, corrective measures and measures to prevent recurrence are promptly taken, and the results of the corrective measures are reported to the Compliance Committee. Those involved in such fraudulent acts will be appropriately handled including punishment under the Rules of Employment etc., and reporting to administrative agencies, etc., if necessary.

Furthermore, even after the completion of the process, JHRA shall follow up sufficiently to protect the whistleblower, for example, by confirming that the fraudulent acts in question have been resolved and that the whistleblower has not been subjected to any disadvantageous treatment because of the reporting.

Implementation of In-house Training

JHRA implements regular compliance training for all officers and employees (including contract and temporary employees, etc.; the same applies throughout this section).

The Compliance Program stipulates that compliance training must be conducted on a regular basis each year, and the status of progress and results of its implementation are reported to the Compliance Committee on semi-annual basis.

The subject matter of compliance training will be determined based on who is participating (new hires all officers and employees, Investment Division officers and employees, etc.), and JHRA fosters a stronger compliance culture by verifying and implementing training that focuses on more timely topics based on trends of amendments to laws and regulations and the results of internal audits, etc.

Training conducted in recent years is shown below.

| Fiscal Year | No. of Times | Main Topics |

|---|---|---|

| FY2021 | 15 |

|

| FY2022 | 14 |

|

| FY2023 | 16 |

|

Risk Management

Approach to Risk Management

●Establishment of risk management system

JHRA, to which JHR entrusts asset management, has established a risk management system for the purpose of ensuring sound management, performing appropriate risk management as a financial instruments business operator, and fulfilling its obligations.

●Basic risk management policy

JHRA's Board of Directors has formulated a basic risk management policy based on its management policy and strategic objectives and supervises the development of an appropriate risk management system. The basic risk management policy is as follows:

- In order to ensure sound management and fulfill its fiduciary responsibilities as a financial instrument business operator, JHRA strives to develop a risk management system based on recognition that appropriate management and control of risks that occur in the course of its business operations are essential issues in management.

- In order to perform appropriate risk management, JHRA shall establish organizations that can exercise mutual check-and-balance, as well as provide appropriate staffing, develop a training system, and implement appropriate measures to prevent accidents.

- Given that there are always intrinsic risks in day-to-day business operations, all of JHRA's officers and employees shall recognize that they need to play a role in risk management and implement operation with understanding of its importance.

●Risk management system with focus on three lines of defense

In recent years, led by financial institutions, publicly listed corporations, etc., risk management systems that focus on a "three lines of defense"-based approach have been developed. JHRA has also adopted this approach.

Specifically, as the "first line of defense," the groups implementing/executing tasks become the risk owners. Heads of groups/offices assess, supervise, and control risks that occur in their tasks, as the risk management officers. Next, as the "second line of defense," the Compliance Office monitors risks and implements measures to control them. The compliance officer serves as chief risk management officer, supervising overall risk management for JHRA and providing the required guidance and oversight as the person in charge. Finally, in the "third line of defense," the validity of the processes created by the first and second lines of defense is evaluated and verified through internal audits and administrative inspections.

As JHR's asset management company, JHRA, based on the "three lines of defense" approach, remains aware that there are always intrinsic risks in its day-to-day business operations, and all officers and employees execute their duties while recognizing that they play a role in risk management.

●Risk management implementation processes

JHRA stipulates the risk management implementation processes and specific procedures in its Code of Risk Management and detailed rules relating to the code. The risk management implementation processes consist of the seven items below, with a risk management sheet used to comprehensively implement each process.

- Development of annual risk management plan

- Risk identification

- Risk analysis/evaluation

- Additional control planning/implementation

- Finalization/approval of risk management sheet

- Monitoring through internal audits and administrative inspections

- Improvement of risk management status

Internal Audit

Based on the Code of Internal Audit, JHRA conducts internal audits in order to verify and evaluate whether its risk management is functioning effectively. Internal audits are conducted at least once per year, and JHRA has been conducting them every year since its establishment.

●Scope and method of internal audits and improvement of designated items

JHRA's internal audits are performed for all organizations and operations. Specifically, risks associated with all organizations and operations are assessed in an integrated manner by using the Risk Management Sheet. Then verification and evaluation is conducted based on the internal audit to determine whether the controls for those risks are functioning effectively.

Once the internal audit is completed, the compliance officer, who serves as the chief controller of internal audit, reports the audit results to the President, Compliance Committee, and the audited departments. Furthermore, if the internal audit deems it necessary, the results will also be reported to the Board of Directors.

The chief controller of internal audit shall verify the status of improvements to matters designated in internal audits with the audited departments and report the results to the President and Compliance Committee. Moreover, if the chief controller of internal audit deems it necessary, the results will also be reported to the Board of Directors.

Crisis Management

Recognizing that crises caused by natural disasters, various criminal activities, system failures, and so forth may have a severe impact on JHR's management and asset management activities in the form of economic loss, significant obstruction of operations, etc., JHRA has formulated Code of Crisis Management and Contingency Plans and implements various measures to minimize damage and ensure employees' safety and peace of mind in the event of a crisis.

●Major measures related to crisis management

- Creation of BCP (business continuity planning) manual

- Implementation of BCP training (once every year)

- Introduction of safety verification system and implementation of simulation training (four times per year)

- Distribution of emergency kit to employees

- Storage of reserve supplies