Initiatives for Environment

- Basic Policy

- Environmental Target

- Environmental Performance Data

- Actual Cases of Initiatives for Environment

- Initiatives for Climate Change

Basic Policy

In response to effective usage of limited resources and aggravation of climate change issue, JHR and JHRA work on monitoring environmental performance, such as energy consumption, CO2 emissions, water consumption and amount of waste generated, etc. and strive to improve them continuously.

Environmental Target

We have set targets to reduce GHG emissions intensity (*1) for long term until 2050.

- 30% reduction of GHG emissions per floor area in our portfolio (GHG emissions intensity) compared to FY2017 (*2).

- To monitor and manage progress towards long term target and to comprehend the causes of variance in emissions at the "ESG Promotion Committee" of JHRA.

| (*1) | The GHG emissions of JHR fall under Scope 3 emissions, Category 13: leased assets (downstream) because the hotels in our portfolio are managed by lessees of hotels, etc. |

|---|---|

| (*2) | The GHG emissions intensity for the baseline year, FY2017 (April 2017 to March 2018) was 0.135 (t-CO2/㎡). |

Environmental Performance Data

| unit | April 2017 to March 2018 (base year) |

April 2020 to March 2021 |

April 2021 to March 2022 |

April 2022 to March 2023 |

||

|---|---|---|---|---|---|---|

| Total floor area | ㎡ | 675,134.95 | 774,639.82 | 771,421.17 | 766,980.61 | |

| Energy | Data coverage ratio | % | 100.0% | 100.0% | 100.0% | 100.0% |

| Usage | MWh | 272,863 | 191,943 | 215,826 | 248,349 | |

| Emissions intensity | MWh/㎡ | 0.4043 | 0.2478 | 0.2798 | 0.3238 | |

| Renewable energy included above | Usage | MWh | - | - | - | 7,669 |

| CO2 | Data coverage ratio | % | 100.0% | 100.0% | 100.0% | 100.0% |

| Emissions | tCO2 | 91,286 | 62,253 | 68,633 | 74,933 | |

| Emissions intensity | tCO2/㎡ | 0.1353 | 0.0804 | 0.0890 | 0.0977 | |

| Reduction rate compared to base year | % | - | 40.6% | 34.2% | 27.8% | |

| Water | Data coverage ratio | % | 100.0% | 100.0% | 100.0% | 100.0% |

| Usage | thousand ㎥ |

2,683 | 1,364 | 1,570 | 2,175 | |

| Emissions intensity | thousand ㎥/㎥ |

0.0040 | 0.0018 | 0.0020 | 0.0028 | |

| Waste | Data coverage ratio | % | 54.4% | 67.8% | 71.0% | 71.4% |

| Emissions | t | 3,743 | 3,111 | 3,179 | 4,461 | |

| Emissions intensity | t/㎡ | 0.0102 | 0.0059 | 0.0058 | 0.0081 | |

| Recycled amount | t | 1,095 | 1,197 | 1,217 | 1,550 | |

| Recycle ratio | % | 29.3% | 38.5% | 38.3% | 34.7% | |

| Independent third-party assurance report | - | Verification obtained |

Verification obtained |

Verification to be obtained |

||

| (*1) | The data coverage ratio represents the proportion of the total floor space of properties for which data could be obtained compared to the total floor space of properties owned during the subject period. The floor space of properties acquired or sold during the subject period is calculated based on the proportionally distributed floor space corresponding to the properties owned. |

|---|---|

| (*2) | Properties owned by JHR are managed by hotel lessees, etc. and the above data is based on the data provided by hotel lessees, etc. |

| (*3) | Amount of CO2 emissions are calculated based on "Institution of calculation, reporting and disclosure of amount of emissions by greenhouse effect gas" established by Ministry of the Environment. |

| (*4) | Numbers may change due to revision of aggregation method. |

| (*5) | The data for waste for the base year is a reference value compiled by the Asset Management Company. |

Actual Cases of Initiatives for Environment

●Switching to LED lighting

We are striving to reduce electricity consumption by switching from conventional lighting to LED lighting at some of the hotels in our portfolio.

-

Oriental Hotel Hiroshima

-

Oriental Hotel Okinawa Resort & Spa

●Introduction of water-saving devices

We strive to reduce water consumption through installing water-saving devices for a restroom, a tap in the kitchen, etc. to adjust water use amount properly.

●Renewal of air conditioners

We reduce electricity consumption by installing inverter control devices on air conditioners for better operational efficiency.

●Reuse of water

Several of our hotels reduce clean water consumption by using well water instead. Some of our hotels in Okinawa are working on to reduce clean water consumption by reusing gray water as recycled water.

●Green Leases

In order to promote environmentally friendly initiatives in our portfolio, we have signed green leases provisions such as providing energy data with the lessees of HMJ Group hotels, which is one of our major hotel groups. JHR analyzes data of energy, etc. provided by hotels and considers renovation to improve environmental performance and works to optimize operation of facilities management. In case of HMJ Group hotels, they can reduce utility expenses through improvement of environmental performance.

Achievement of green lease provision (end of FY2023)

| No. of Properties | Proportion of Total Floor Area |

|---|---|

| 20 | 60.9% |

●Green Building Certifications by third-party institutions

In order to confirm the credibility and objectivity of our initiatives aimed at reducing our environmental impact, we have obtained green building certifications from third-party institutions.

Achievement of certification from third-party institutions

| Fiscal Year | FY2020 | FY2021 | FY2022 | FY2023 |

|---|---|---|---|---|

| No. of properties newly acquired certifications |

1 | 1 | - | - |

| Cumulative ratio in portfolio (based on total floor area) |

14.7% | 17.2% | 17.2% | 16.5% |

■CASBEE Certification for Buildings

"Comprehensive Assessment System for Built Environment Efficiency (CASBEE)" is a method for evaluating and rating the environmental performance of buildings. It is a system to comprehensively evaluate the quality of buildings, including interior comfort and landscape considerations, as well as environmental considerations such as energy conservation and the use of materials and equipment with low environmental loads.

CASBEE for Buildings (Existing Buildings) is an evaluation method which targets buildings with an operational record of at least one year after completion, and assesses buildings based on annual performance of operations, deterioration of buildings and interior environments. Assessment results by CASBEE are indicated in a scale with the following five ranks: "S: Superior," "A: Very Good," "B+: Good," "B-: Slightly Poor," and "C: Poor."

See here for details of CASBEE

http://www.ibec.or.jp/CASBEE/english/index.htm

Oriental Hotel Fukuoka Hakata Station

THIS TABLE CAN SCROLL TO THE LEFT OR RIGHT.

| Location | 4-23, Hakataeki Chuogai, Hakata-ku, Fukuoka city, Fukuoka |

CASBEE for Buildings |

|---|---|---|

| Acreage | 2,163.42 ㎡ | |

| Total Floor Space | 18,105.42 ㎡ | |

| Structures and Stories | SRC/12 stories above ground with 3 stories below ground | |

| Building Completion | July 1985 | |

| Details of Properties | ||

Hilton Tokyo Odaiba

THIS TABLE CAN SCROLL TO THE LEFT OR RIGHT.

| Location | 1-9-1, Daiba, Minato-ku, Tokyo |

CASBEE for Buildings |

|---|---|---|

| Acreage | 18,825.30 ㎡ | |

| Total Floor Space | 64,907.76 ㎡ | |

| Structures and Stories | S/SRC with flat roof, 14 stories above ground and 1 story below ground | |

| Building Completion | January 1996 | |

| Details of Properties | ||

■BELS (Building-Housing Energy-efficiency Labeling System) Evaluation

"BELS" is a public valuation and display system under a guideline by the Ministry of Land, Infrastructure, Transport and Tourism to evaluate the energy conservation performance of each building, which was launched in April 2014. A third-party institution verifies the energy performance of a building by evaluating its primary energy consumption and labels the performance of both new and existing buildings. The evaluation result is graded on five scales based on energy performance (from one star "★" to five stars "★★★★★.")

See here for details of BELS (Japanese only)

https://www.hyoukakyoukai.or.jp/bels/info.html

Hotel Nikko Alivila

THIS TABLE CAN SCROLL TO THE LEFT OR RIGHT.

| Location | Nakagami-gun, Okinawa |

Evaluation Agent: |

|---|---|---|

| Acreage | 65,850.05 ㎡ | |

| Total Floor Space | 38,024.98 ㎡ | |

| Structures and Stories | SRC/10 stories above ground with 1 story below ground | |

| Building Completion | April 1994 | |

| Details of Properties | ||

Mercure Okinawa Naha

THIS TABLE CAN SCROLL TO THE LEFT OR RIGHT.

| Location | Naha city, Okinawa |

Evaluation Agent: |

|---|---|---|

| Acreage | 2,860.69 ㎡ | |

| Total Floor Space | 10,884.25 ㎡ | |

| Structures and Stories | RC/14 stories above ground | |

| Building Completion | August 2009 | |

| Details of Properties | ||

UAN kanazawa

THIS TABLE CAN SCROLL TO THE LEFT OR RIGHT.

| Location | Kanazawa city, Ishikawa |

Evaluation Agent: |

|---|---|---|

| Acreage | 729.91 ㎡ | |

| Total Floor Space | 2,606.85 ㎡ | |

| Structures and Stories | S with flat roof, 6 stories above ground | |

| Building Completion | September 2017 | |

| Details of Properties | ||

●Investing in mixed-use buildings

We are investing in mixed-use facilities that fall within the scope of our asset management, as stipulated in the Articles of Incorporation.

ACTIVE-INTER CITY HIROSHIMA

(Sheraton Grand Hiroshima Hotel)

High-rise hotel and office tower within ACTIVE-INTER CITY HIROSHIMA, a mixed-use facility comprised of hotels, offices, and commercial facilities located next to JR Hiroshima Station.

Mercure Yokosuka

High-rise hotel within Bay Square Yokosuka Ichibankan in Yokosuka city. Bay Square Yokosuka Ichibankan is a landmark mixed-used facility consist of hotel, Yokosuka Arts Theatre, Yokosuka Industrial Community Plaza, etc.

●Investing in Urban Redevelopment

We are investing in urban redevelopment projects.

Oriental Hotel Fukuoka Hakata Station

Hotel located next to the JR Hakata Station Chikushi Exit rotary and connected to the Hakata Station subway station via an underground passage. In the vicinity of Hakata Station, a station-front plaza redevelopment project is under way, for which we carried out renovation work including for a corridor extending from the underground passage to the aboveground entrance/exit.

Initiatives for Climate Change

Our (JHR) Awareness of Climate Change

In 1992, "United Nations Framework Convention on Climate Change (hereinafter called "Convention")," with the ultimate goal of stabilizing the concentration of greenhouse gases in the atmosphere was adopted, and it was agreed to take action against climate change worldwide. Based on the Convention, the Conference of the Parties to the United Nations Framework Convention on Climate Change (hereinafter called "COP"), was held every year since 1995. At COP 21 in 2015, all 196 countries, including developed and developing countries, which are members of the Convention, adopted the "Paris Agreement", which sets a common reduction target (strive to limit global warming to well below 2℃ and make additional effort to limit it to 1.5℃). As a result, recognition and initiatives of tasks for climate change became more concrete.

Japan has also been actively working on climate change issues and announced in 2020 that Japan will reduce greenhouse gas emissions to virtually zero by 2050 (hereinafter called "Carbon Neutral Declaration") based on the Paris Agreement. Carbon neutrality is also positioned as a basic principle in "Act on Promotion of Global Warming Countermeasures," and it is expected to accelerate decarbonization initiatives, investments, and innovation as well as to further promote decarbonization initiatives utilizing renewable energy in local areas and decarbonization management by companies.

JHR believes that the climate change action, which are being discussed as a global initiative, are not restrictions on economic growth but are key to generate a major shift in industrial structure and strong growth through drastically transforming the economy and society, encouraging investment and improving productivity. Therefore, JHR recognizes that properly identifying, assessing, and managing the "risks" and "opportunities" caused by climate change is essential to enhancing business resilience and ensuring our sustainability, and has positioned action to climate change as one of our materialities (key issues).

Expression of Support for the TCFD Recommendations by the Asset Management Company

TCFD is the "Task Force on Climate-related Financial Disclosures" established by the Financial Stability Board (FSB) in 2015 to encourage companies to disclose appropriate information and to encourage investors and others to make appropriate investment decisions, and recommended disclosure themes within the framework in its final report in 2017.

Based on the recognition that "climate change will cause dramatic changes in the natural environment and social structure and is important issue that will have a significant impact on the management of investment corporations," JHRA, which is asset management company of JHR, judged that it is important to promote disclosure based on the TCFD recommendations and expressed its support for the TCFD recommendations in November 2021.

At the same time, JHRA joined the TCFD Consortium, an organization of Japanese companies that support the TCFD recommendations.

Through the activities of the TCFD Consortium, JHRA promotes the study of effective information disclosure and initiatives to link the disclosed information to appropriate investment decisions by financial institutions, etc., while striving to expand appropriate information disclosure of JHR.

<Disclosure framework of TCFD>

| Recommended Disclosure Themes | Governance | Strategy | Risk Management | Metrics and Targets |

|---|---|---|---|---|

| Description (Summary) |

The organization's governance around climate-related risks and opportunities | The actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning | The processes used by the organization to identify, assess, and manage climate-related risks | The metrics and targets used to assess and manage relevant climate-related risks and opportunities |

Initiatives for Four Disclosure Themes Recommended by TCFD

●Governance

JHR has established the following governance structure to address climate-related risks and opportunities.

- The chief executive officer for Climate-related issues shall be the President, who is the chief executive officer for Sustainability Promotion.

- The executive officer responsible for management of climate-related issues shall be the Managing Director, head of Finance and Planning Division, who is the executive officer responsible for management of sustainability promotion.

- The ESG promotion committee shall consider specific goals and measures, cooperate in implementing measures, and monitor progress for the purpose of promoting sustainability, including environmental considerations. The ESG Promotion Committee consists of the chief executive officer, the executive officer, management members and ESG team meeting members.

- The ESG Promotion Committee shall determine and implement matters related to action to climate change, including identification and assessment of climate change impacts, monitor progress in initiatives to manage risks and opportunities, and the setting of metrics and targets.

For an overview of the responsible persons and the ESG Promotion Committee above, please refer to "Sustainability Promotion System" within Sustainability Management.

●Strategy

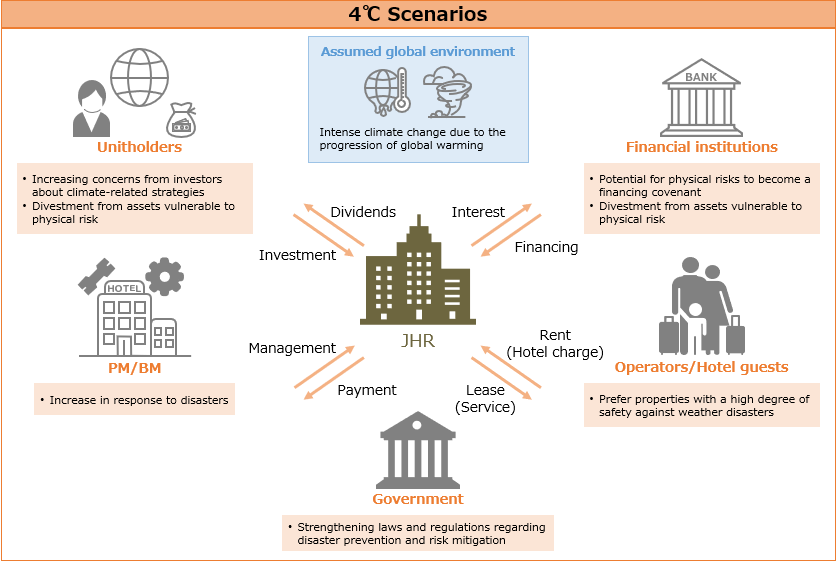

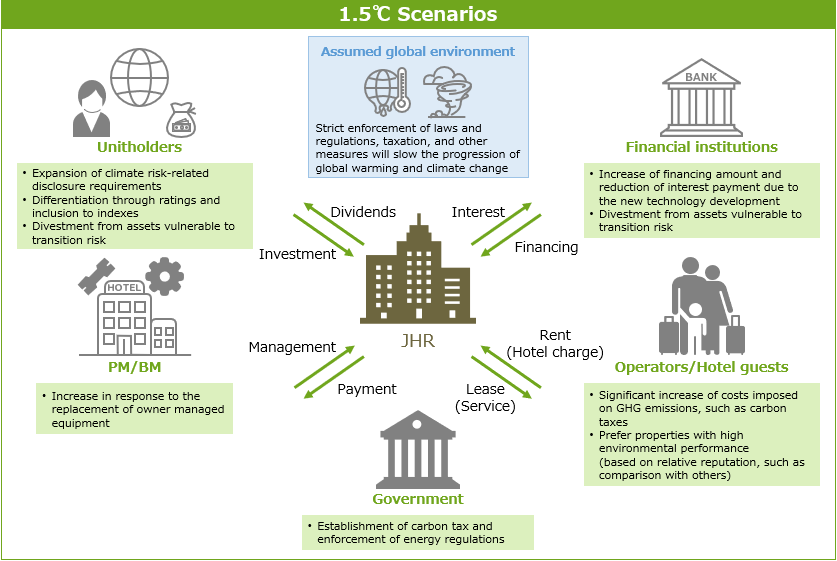

In order to examine the impact of climate-related risks and opportunities on the JHR's business, strategy and financial plan, we conducted scenario analysis using the 4℃ and 1.5℃ scenarios. In the scenario analysis, we refer to the Fifth Assessment Report published by the IPCC (Intergovernmental Panel on Climate Change of the United Nations) and World Energy Outlook 2020 published by the IEA (International Energy Agency) to analyze the impact on JHR's business by measures such as Japanese government's "Carbon Neutral Declaration" in mind for the transition of the social economy to decarbonization and the increasingly serious and frequent occurrence of natural disasters due to the progress of climate change.

Reference Scenarios

| Scenario | Transition Risk | Physical Risk |

|---|---|---|

| 4℃ Scenarios | STEPS (IEA WEO2020) | RCP8.5 (IPCC Fifth Assessment Report) |

| 1.5℃ Scenarios | NZE2050 (IEA WEO2020) | RCP2.6 (IPCC Fifth Assessment Report) |

Global Outlook based on Scenario Analysis

- 4℃ Scenarios:

- Enforcement of various laws and regulations to achieve a decarbonized society to be stagnant, and there is no significant change from the present state. The scenarios with high physical risk due to no reduction in greenhouse gas emissions compared to 1.5℃ scenarios, but low risk of transition toward a decarbonized society.

- 1.5℃ Scenarios:

- Various laws and regulations will be enforced to achieve a decarbonized society. Scenario with lower physical risks due to reduced greenhouse gas emissions compared to 4℃ scenarios, but higher transition risks toward a decarbonized society.

Climate-related risks and opportunities (short-, medium- and long-term climate-related risks and opportunities and financial impacts)

For each of the above 4℃ and 1.5℃ scenarios, we have evaluated the magnitude of the financial impacts on JHR which will be caused by the identified risks and opportunities. For each scenario, we evaluated the impact in the years 2025 (short-term), 2030 (medium-term) and 2050 (long-term) on a scale of large, medium and small.

The accuracy of this assessment is not guaranteed, as it is a relative impact assessed based on a qualitative analysis and includes various factors such as uncertain assumptions and unknown risks over the medium to long term. A summary of the results is shown in the table below.

<Financial Impact Based on Scenario Analysis>

| Category | Risk and Opportunity Factors |

Financial Impact | Initiatives and Countermeasures |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Changes | Classifi- cation |

4℃ | 1.5℃ | |||||||

| Short- term |

Mid- term |

Long- term |

Short- term |

Mid- term |

Long- term |

|||||

| Transition Risks | ||||||||||

| Policy and Legal |

Strengthening taxation on GHG emissions through the introduction of a carbon tax | Increase in tax burden on GHG emissions from properties under management | Risks | Minor | Minor | Minor | Minor | Mode- rate |

Major |

|

| Expansion and mandate of labeling systems related to energy efficiency and sustainability initiatives for buildings | Rise in expense of acquiring environmental certification | Risks | Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

||

| Technology | Evolution and diffusion of renewable energy and energy-saving technologies | Increase in expenses for introducing new technology for equipment in properties under management | Risks | Minor | Minor | Minor | Minor | Minor | Mode- rate |

|

| Reduction of utility costs through the introduction and replacement of equipment with high energy-saving performance | Oppor- tunities |

Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

|||

| Market and Reputation |

Changes in the investment attitude and investment and financing decisions of market participants | Deterioration of financing conditions and increase in financing costs due to delay in response to climate change | Risks | Minor | Minor | Minor | Minor | Minor | Mode- rate |

|

| Increase funding volume and lower funding costs by responding to and appealing to investors who are concerned about environmental issues | Oppor- tunities |

Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

|||

| Change in demand from hotel lessees and hotel guests (avoiding properties that are less climate-responsive) | Decrease in rents due to increased costs for responding to the demands of hotel lessees, etc. and hotel users (guests) and deterioration of reputations due to non-response | Risks | Minor | Minor | Minor | Minor | Minor | Mode- rate |

||

| Increase market recognition and market competitiveness as an eco-friendly property | Oppor- tunities |

Minor | Minor | Minor | Minor | Mode- rate |

Mode- rate |

|||

| Physical Risks | ||||||||||

| Acute | Damage to property caused by typhoons and other wind damage | Increase in repair and insurance costs, loss of sales opportunities and lower occupancy rates | Risks | Minor | Minor | Mode- rate |

Minor | Minor | Minor |

|

| Floods of nearby rivers and rainfall inundation caused by torrential rains, etc. | Increase in repair and insurance costs, loss of sales opportunities and lower occupancy rates | Risks | Minor | Minor | Mode- rate |

Minor | Minor | Minor | ||

| Chronic | Increase in demand for air conditioning due to increase in extreme weather conditions such as extremely hot and cold weather | Increase in utility costs, as well as maintenance and repair costs | Risks | Minor | Minor | Mode- rate |

Minor | Minor | Minor |

|

| (※) |

"Transition Risks" and "Physical Risks" are as follows. "Transition Risks": Business impacts arising from the social economy's transition to a low-carbon, decarbonized economy

"Physical Risks": Business impacts resulting from progress of climate change and shifts from traditional climate patterns and phenomena

|

●Risk management

Premise of Risk Management (Identification and Assessment of Risks)

At JHRA, which is entrusted with asset management of JHR's assets, ESG Promotion Committee mainly plays a central role. ESG Promotion Committee identifies and assess climate-related risks as well as consider and decide business strategies to manage risks and countermeasures as one of the ESG issues. The processes of identification and assessment are as follows.

- Under the direction of the executive officer responsible for management of climate-related issues, an internal ESG team (hereinafter called "ESG Team"), which formulates goals, studies measures, and monitors their implementation status with respect to ESG-related issues, identifies and assess climate-related risks to JHR.

- ESG Team identifies and assess climate-related risks based on the classification of "Transition risks" and "Physical risks" and report the results (progress) at the ESG Promotion Committee.

- ESG Promotion Committee deliberates on climate-related risks and prioritized measures to manage climate-related risk which judged to be corresponded as priority based on the results of the ESG Team's identification and assessment of climate-related risks, including their potential to materialize and their financial impact and other factors. In addition, when climate-related opportunities are reported, the team prioritizes them within the business strategy.

For an overview of ESG Promotion Committee and ESG Team, please refer to "Sustainability Promotion System" within Sustainability Management.

Management of climate-related risks

The processes for managing the assessed climate-related risks are as follows.

- The executive officer responsible for management of climate-related issues will instruct the ESG team to formulate an action for the key climate-related risk factors that ESG Promotion Committee has decided to prioritize correspondence.

- Depending on its content, the action formulated by ESG team will be decided and implemented based on the necessary decision-making system within the asset management company including ESG Promotion Committee.

- Regarding the action decided on, ESG team summarizes the status of the progress and the impact by the action, and reports to ESG Promotion Committee. ESG Promotion Committee appropriately manages the risk through management of progress of the action and provide instructions on the formulation of new measures, etc. based on the report by ESG Team.

For an overview of Risk management, please refer to "Governance" within ESG.

●Metrics and targets

Based on the recognition that solving environmental issues represented by climate change is one of the most important management issues for stable medium- and long-term growth of the JHR, we are promoting low carbonization of our portfolio and energy use efficiency through environmental and energy-saving measures.

Greenhouse Gas (GHG) emissions

JHR has set a target to reduce GHG emissions intensity by 30% until 2050 (compared to FY2017) as a long-term goal.

Since the properties owned by JHR are managed by hotel lessees, etc. and their GHG emissions fall under Scope 3, Category 13, Leased Assets (downstream), the sum of direct emissions from fuel consumption (Scope 1) at the properties and indirect emissions from consumption of purchased electricity, etc., which converted final energy consumption into annual CO2 emissions (Scope 2) reported by the hotel lessees, etc. are used as GHG emissions for JHR.

The GHG emissions are calculated as follows.

-

Scope 1

CO2 emissions are calculated by multiplying the calorific value of each type of fuel (gas, heavy oil, kerosene, etc.) burned on-site by the "carbon emission conversion factor for each fuel type × 44/12." -

Scope 2

Calculated only for electricity and the heat supplied from offsite sources (district heating and cooling, etc.). CO2 emissions are calculated by multiplying each consumption by the emission factor for respective suppliers or by the emission factor specified by the government.

Others

JHR is striving to reduce GHG emissions and take the following environmental measures and others at the properties it owns, aiming to build a portfolio that make reduction of environmental impact compatible with consideration of all stakeholders, including hotel guests.

- We have a plan in place to eliminate the use of specified CFCs (CFC) and alternative CFCs (HCFC, HFC) in short period by identifying the refrigerants used in the air-conditioning equipment of all properties owned by JHR.

- With regard to ODP and GWP, we aim to figure out the ODP and GWP of all refrigerants used in our properties.

- Upon renewal of air conditioning equipment, we make selection of equipment with consideration to ODP and GWP usage.